AEROSPACE POWER

Lockheed Martin photo.

Lockheed-Martin F-35A on its first night flight, 18 January 2012.

The Next Generation Fighter Club: How Shifting Markets will Shape Canada's F-35 Debate

by Marco Wyss and Alex Wilner

Dr. Marco Wyss is a Senior Researcher at the Center for Security Studies (CSS) at the Swiss Federal Institute of Technology (ETH) in Zurich. He earned his doctorate at the Universities of Nottingham and Neuchâtel, and holds Masters degrees from the University of Neuchâtel and the Graduate Institute of International and Development Studies, Geneva. Prior to joining the Center, he held Assistantships at the University of Neuchâtel, and was a Visiting Fellow at the London School of Economics and Political Science, and a Visiting Scholar at the George Washington University’s Elliott School of International Affairs.

Dr. Alex Wilner is a Senior Researcher at the CSS. A native of Montreal, he holds a Doctorate and Master’s degree from Dalhousie University, and a Bachelor’s degree from McGill University. He has been published widely, including in Comparative Strategy, Perspectives on Terrorism, the Journal of Strategic Studies, Studies in Conflict and Terrorism, the Israel Journal of Foreign Affairs, the International Journal, The Globe and Mail, and The National Post.

For more information on accessing this file, please visit our help page.

Introduction

The international market for fighter jets is in for a period of tumultuous change. New aircraft that incorporate ‘fifth-generation’ technology will soon be entering the production phase, and are expected to enter military service in the coming decade. When they do, some producers of combat aircraft will find themselves overshadowed by rising challengers; others may cease to exist altogether. With little doubt, the fighter jet industry will become increasingly polarized. The Americans and the Russians will retain their preeminent positions but they will be joined by China. Europe, on the other hand, is likely ‘heading for the exit.’

Shifting technological demands and the future structure of the fighter jet industry will leave a mark on Canada’s air force. Global trends in the production of military hardware matter because where Ottawa buys its weapons can be just as important as what it buys. The arms trade is a political minefield. There are costs associated with procuring fighter jets that go well beyond the monetary value of each aircraft. The arms trade and the transfer of sophisticated military technology between states are as much driven by political demands as they are by strategic rationales. All things considered, and notwithstanding the ongoing debate over Canada’s planned purchase of the Joint Strike Fighter (JSF), the Lockheed Martin F-35 Lightning II, the simple truth is that Canada has very few palatable alternative options.

The JSF remains a contentious albeit promising program. The aircraft is being produced by a U.S.-led consortium of eight (unequal) partners, of which Canada is a junior member.1 When it goes operational, the F-35 will be the most sophisticated multi-role fighter in the sky. While falling short of introducing a full-blown technological revolution, the F-35 and its emerging fifth-generation contemporaries represent the future. Already, Canada’s main allies have signaled their intent to fly F-35s. For Canada, doing the same guarantees interoperability. And given that uncertainty is the only certainty in international relations, ensuring Canadian pilots are flying the best machines into future combat will go a long way in making sure they can do their jobs safely and expeditiously. Naturally, the JSF has its faults. The program has suffered from a number of production and testing delays, and it appears to be exorbitantly expensive. But the bottom line remains: if Canadians are set on equipping their military with the most advanced arms available, political considerations and market demands all but guarantee that their only choice of aircraft is the F-35.

Our argument is structured as follows. We begin by outlining the traditional arguments offered by both proponents and opponents of the F-35. We turn next to a discussion of the evolving global fighter jet industry, illustrating how fifth-generation aircraft will transform the market. In the third section, we discuss the theory and policy of purchasing weapons. We then conclude by reflecting upon Canada’s procurement options in light of global market shifts and practical considerations.

The F-35: Today’s Debate

In July 2010, Canada signaled its intent to purchase 65 F-35 Lightning IIs.2 That decision led to a fierce national debate that eventually became a central theme of the federal election held in May 2011. The debate is marked by several competing claims.

In general, proponents of the F-35 rely upon four arguments. First, they suggest that Canada needs to replace its ageing CF-18 Hornets with a sophisticated fighter jet so as to protect its sovereignty and regional interests. The complexity of safeguarding Canadian sovereignty, adds Lieutenant-General (ret’d) Lloyd Campbell, a former Chief of the Air Staff of Canada’s air force, requires a manned aircraft rather than an Unmanned Aerial Vehicle (UAV), or a combat drone.3 Simply put, the F-35 will help ensure Canada can continue to defend its national interest while effectively partnering with the U.S. in the North American Aerospace Defence Command (NORAD).

DND photo CX2995-0096-143a by Private Vaughn Lightowler.

A CF-18 Hornet in a Nordic setting. They are rapidly nearing the end of their service lives.

Second, JSF supporters suggest that nobody can predict the nature, ferocity, or geographic location of future combat missions, so it would be prudent for Canada to prepare for any and all possible scenarios by equipping itself with the best hardware available. The 2011 Libyan air war is a case in point. Few envisioned that Canada would be called upon to support NATO in enforcing a UN-mandated mission in North Africa. That Canada sent seven CF-18 fighter jets (along with several reconnaissance aircraft and air-refueling tankers) to Libya, and dropped 330 laser-guided bombs on targets in the first three months of combat alone caught analysts by surprise. The Libyan conflict demonstrates once again that Canadian fighter pilots could be tasked at any moment with carrying out unpredicted, multilateral combat missions well outside Canada’s ‘traditional’ field of operations. The F-35 allows Canada to hedge against the ‘unknown unknowns’ of international affairs. Despite what the Israeli military historian and theorist Martin van Creveld describes as the “fall of air power,” and notwithstanding the role helicopters and drones have in counterinsurgency operations such as Afghanistan, manned fighter aircraft are not yet obsolete.4

Third, proponents point to Canada’s history to illustrate that Ottawa rarely – if ever – operates in a theatre of war without its allies. If Canada wants to use air power to do anything other than defend its sovereignty in the coming decades, military interoperability with its allies will be of paramount importance.5 Whenever Canada has deployed its CF-18s internationally – the 1990-1991 Gulf War, the 1998/1999 Kosovo Air Campaign, and the 2011 Libyan Air Campaign – it has done so as part of a coalition. The U.S., the UK, Australia, Denmark, Italy, the Netherlands, Turkey, and Norway are all likely to be flying F-35s by 2020. The benefit of joining them is guaranteed interoperability. Canada can decide to fly different aircraft into combat, but there are risks in doing so when part of a coalition. In the early phases of the Libyan conflict, for instance, Sweden’s contribution to the mission – eight JAS Gripen fighter jets – was grounded at the Sigonella airbase in Sicily, because the base carried jet fuel incompatible with Swedish aircraft. “This really should have been investigated as soon as we arrived,” offered Lieutenant Colonel Mats Brindsjö, head of the Swedish Air Operation Center, “but we didn’t have time with all the other details.”6 Unfortunately for the Swedes, anticipating the finer details is a prerequisite of participating in a theatre of conflict. When Canada flies F-35s alongside its allies in a future combat environment, it will ensure its pilots have the right tools to work effectively and safely with others.

Finally, and most importantly, the F-35 is a fifth-generation fighter. As a class of fighters, these aircraft feature all-aspect stealth with internal weapons, extreme agility, full-sensor fusion, integrated avionics (the entire suite of electronic communications, navigation, display, and control instruments), and some or full supercruise (the ability to fly continuously at supersonic speed without use of afterburner).7 Although the F-35 is not designed to supercruise and operates in afterburner,8 the aircraft does integrate the other major fifth- generation properties, significantly reducing its vulnerability. Furthermore, the synthesis of data in the cockpit gives the pilot a better overview of the tactical situation in line with the doctrine of network-centric warfare. Lieutenant-General André Deschamps, the current Chief of the Air Staff of the Royal Canadian Air Force, argues that the F-35 is “… revolutionarily different in terms of capability.”9 It will have a qualitative edge over older, fourth generation models like the CF-18, and upgraded models, like the F-18 Super Hornet. The only comparable operational fifth-generation aircraft is the F-22 Raptor, flown exclusively by the United States Air Force. But Washington is phasing out the Raptor’s production, having placed all its hopes on the F-35.10

Lockheed Martin photo.

This Lockheed Martin F-22 Raptor performed precision aerobatics at the Fort Worth Alliance Air Show 30-31 October 2011.

Opponents of the F-35 counter in a number of ways. First, they suggest that Canada was too hasty in siding with the JSF and propose that other aircraft should be considered. They also point to the conflict in North Africa for insight, illustrating that Canada’s CF-18s have done an exemplary job in Libya. Why buy the superbly-expensive F-35 if cheaper, less sophisticated options – like the Super Hornet – would meet Canada’s needs? To F-35 critics, the Libyan air war highlights the continued utility of this generation of aircraft, so the best bet for Canada is to allow for a competitive tender that considers alternatives to the JSF . As India’s and Australia’s purchases of fourth-generation fighters have recently demonstrated, sophisticated aircraft can be purchased from a number of sources, and, as the U.S. is now doing to its fleet of F-15s and F-16s, older aircraft can be upgraded to extend their service.11 Canada could, critics suggest, also purchase an alternative to the F-35. Yet this criticism neglects the fact that these countries are trying to fill medium-term gaps in national capability rather than replace fifth-generation options altogether. Australia has signalled that it will fly the F-35 and India has bought into Russia’s fifth-generation fighter project. Neither is replacing these future purchases with upgraded fourth-generation fighters. Instead, they are ensuring they have the short-term capability to properly defend their interests in the time it will take them to integrate newly-acquired fifth-generation fighters into their fleets.12

Second, some critics suggest that the F-35 is not as effective a fighter jet as proponents make it out to be. Winslow Wheeler, the Director of the Straus Military Reform Project at the U.S. Center for Defense Information, takes issue with the “performance rhetoric” that accompanies the F-35, arguing that its stealth capabilities are overblown, the aircraft is “bulky,” and its engine less effective than presumed.14 Other critics suggest the aircraft will lack the capability to communicate in Canada’s Arctic until the proper software is made available in 2019.14 The F-35 also has ‘experienced some bumps’ during its testing phase. In March 2011, for instance, an F-35 Lightning II experienced dual-generator failure. All F-35s were grounded and testing put on hold until the problem was solved. Other critics claim that the F-35’s multi-role capability compromises on individual criteria better met by separate and different models of aircraft.15 At the very least, critiques conclude, Canada should wait to confirm its F-35 purchase until all testing has been completed. Admittedly, the F-35 is still being tested, and there remain many unknowns with respect to its performance. But as tests proceed, they apparently reveal flight characteristics which are similar to and better than those of the F/A-18 Hornet.16 In addition, alongside stealth, the JSF ’s “real strength,” explains Lloyd Campbell, “is its integrated defensive and offensive sensor systems that provide the aircraft with the ability to see, identify, and counter everything around it, day or night.”17 Arguably, it is highly likely that the F-35 will outclass previous generations of fighters.

Third, critics point to the JSF ’s cost. Much of the debate in Canada and elsewhere has centered on the program’s rising price tags. Canada has committed $9 billion for the purchase of 65 aircraft, along with simulators, spare parts, and other hardware. Critics contend these figures are grossly inaccurate. Wheeler pegs the unit cost of each F-35 at $155 million, not the suggested $70 million that the Canadian Government cites. And Canada’s Parliamentary Budget Officer (PBO), in March 2011, forecast the total ownership cost for 65 F-35s over a period of thirty years at nearly $30 billion. Others, however, such as David Perry, a doctoral candidate and a defence analyst with the CDA Institute, have illustrated the difficulty of accurately pinpointing the overall and unit costs of the JSF . Comparing figures attributed to Canada’s Department of National Defence, the PBO, and the U.S. Government Accountability Office, Perry writes, “is misleading as doing so essentially compares apples and oranges.”18 The F-35 is certainly expensive, but how expensive is unclear.

Finally, in light of threats by U.S. Senators John McCain and Carl Levin to oppose shifting defence budgets to cover the JSF ’s cost overruns, there are fears that the U.S. might scrap the F-35 altogether. U.S. Defense Secretary Leon Panetta ‘rattled a similar sabre’ in November 2011 when he warned that drastic cuts to the defence budget would lead to the cancellation of the program.19 Notwithstanding fiscal constraints, these fears are unfounded.20 Despite gross cost overruns, the JSF program is considered essential to U.S. national security. Washington has placed all its hopes for the future equipment of its armed forces on the F-35, which is the only manned fighter currently under development in the U.S.. Dropping the program altogether would leave the U.S. without a next generation fighter, and few means to credibly project air power in the coming decades. Likewise, the JSF was designed to replace a variety of aircraft types and will retain a quasi-monopoly on the Western fighter market as a result.21 That many air forces are contemplating replacing their rapidly ageing fourth- generation fighter fleets with next generation models like the F-35, should give the Americans a way to recoup some of the costs of the program. Besides the nine JSF partners, Singapore and Israel are planning their own purchases. And in coming years, the U.S. may eventually widen the circle of potential F-35 customers. It seems prepared to offer the aircraft to Japan (Japan’s acceptance of the F-35 announced 19 December 2011-Ed.), and India, for instance, and there are indications that Washington may eventually – in the coming decades – extend a version of the jet to the United Arab Emirates (UAE) and Saudi Arabia.22

The F-35: Tomorrow’s Debate 23

Making an informed decision with respect to Canada’s next fighter jet requires going beyond the current debate and taking global factors into consideration. Of greatest concern are the shifting dynamics of the global market for combat aircraft. For the most part, Canada’s F-35 debate has yet to properly take these factors into consideration. If Canadians want to equip their air force with the best available tools, it makes sense to focus upon next generation technology. There is little point in looking backwards. The future rests with fifth-, not fourth- generation fighters. While critics are right to point to the F-35’s flaws and costs, neither criticism negates the fact that the future of the global fighter jet industry will eventually be centred around fifth generation technology. It is where that technology is based that will determine Canada’s purchasing options.

Fourth-Generation Fighter Market

Currently, the global market for combat jets is dominated by fourth-generation fighters and their upgraded cousins, known as 4+ and 4++ generation fighters. Fourth-generation aircraft integrate pulse-Doppler radar and look-down/shoot-down missiles (which help localize and detect targets) and increased manoeuvrability. The upgraded 4+ and 4++ fighters include additional capabilities: high agility, sensor fusion, and reduced signatures; and an active phased-array radar (a system with an electronically guided beam), partial stealth capability, and, to some extent, supercruise capability, respectively.24 In today’s conflict environment, these aircraft remain highly competitive. During the Libyan Air Campaign, for instance, the French Rafale, the Swedish Gripen, British-flown Eurofighter Typhoons, and U.S. F-16s have all performed well.

.jpg)

Lockheed Martin photo.

The high technology cockpit of the Lockheed Martin F-35 Lightning II

In terms of market distribution, only twelve countries build fighter aircraft. Although the industry is primarily privately owned, few military development programs can survive without the support of their respective governments. It is usual, then, to equate the production of a jet aircraft with a national program. Currently, China, France, India, Japan, Russia, Sweden, and the U.S. develop and build fighter jets. Pakistan also has an indigenous program, the JF-17 Thunder, but it is largely controlled by China, which co-developed the fighter.25 And a multinational European consortium, consisting of Germany, Italy, Spain, and the UK, came together to produce the Typhoon.

Of all producers, the market is dominated by the U.S. and Russia. Their 4+ and 4++ generation aircraft – the various modernized versions of the U.S. F-15 (like the F-15 Silent Eagle), F-16, and F/A-18 and the Russian Su-30MK, Su-35, MiG-29SMT, and MiG-35, respectively – are (and are expected to be) exported in fairly large quantities.26 Between 2005 and 2009, the U.S. exported 331 new aircraft (and produced a similar amount for their own use) while Russia exported 215 fighters. These figures translate into a 34 and 22 percent share of the global market respectively. Exports by other countries, which primarily supply their own air forces, are comparatively small. In the case of China (41 exports) this is intentional. Beijing’s primary concern is to equip the People’s Liberation Army Air Force as quickly as possible, which is in line with its 2008 White Paper and its anti-access/area denial defensive strategy.27 But the three European producers, who are keen to recoup the costs of their programs with external sales, have so far failed to penetrate the market. In the past five years, Sweden sold 37 Gripens, the Eurofighter consortium exported only 24 aircraft, while France has yet to sell even one Rafale abroad.28 To date, Paris has proven exceptionally incapable of securing an order for its fighter. For example, in November 2011, the UAE, despite an aggressive marketing campaign and personal involvement by French President Nicholas Sarkozy, handed France a “stinging rebuke” by sidelining the Rafale.29 The affordable and simply designed Pakistani JF-17, on the other hand, might eventually prove a successful export, especially to developing countries.

Boeing photo copyright.

Boeing F-15 Silent Eagle launches an AIM-120 air-to-air missile.

The small group of producing countries solicits bids from and supplies a broad range of countries. Most of the combat aircraft exported since 2005 have gone to India, Israel, or the United Arab Emirates, whose purchases account for roughly one-third of global sales. While India and China are mainly supplied by Russia, other countries, such as Israel, the UAE, South Korea, and Singapore procure most of their combat aircraft from the United States. Sweden has sold smaller batches of Gripens to the Czech Republic, Hungary, and Thailand. Germany and the UK have had some limited success selling the Eurofighter to Austria and Saudi Arabia.30 Australia is purchasing – as mentioned earlier – two dozen Super Hornets from the US to bridge the gap until the delivery of its F-35s.31 Producing countries are also courting smaller buyers, like Switzerland, in order to secure orders.32 However, the most hotly contested procurement programs are those of the rising powers of India and Brazil. In April 2011, India’s Medium Multi-Role Combat Aircraft program – a US$ 10 billion project to purchase roughly 125 fighters – finally whittled the international competition down to the Rafale and Typhoon, ‘dealing a blow’ to U.S. producers.33 With respect to the Brazilian program, which is worth an estimated US$ 4 billion to US$ 7 billion, the Super Hornet, Rafale, and Gripen are still in the running. The program is, however, suffering delays.34 More generally, in light of crumbling Western defence budgets, jet-makers are increasingly focusing upon the promising Asian market.35

Clearly, the production and purchase of fighter jets is a vibrant and highly competitive affair. Indeed, combat aircraft dominate global arms transfers. According to the Stockholm International Peace Research Institute (SIPRI), fighter jets and their related weapons and components account for 33 percent of the global “volume of transfers of major weapons” among and between states. Consider further that of the top 100 arms-producing companies in the world, the top three built combat jets, and the top ten either produced jets or components and weapons for jets.36

Lockheed Martin photo.

F-35s in formation

Fifth-Generation Leap

War and technology go hand-in-hand. As Martin van Creveld has noted, “… war [and the hardware to wage it] is completely permeated by technology and governed by it.”37 Yet, technology evolves, and, as a consequence, arms markets change. Canadians would be wise to avoid being unduly swayed by current market forces in contemplating their next fighter purchase. The dawning age of the fifth-generation fighter is going to produce global winners and losers. Although the U.S. began developing the JSF , its second fifth-generation model, in the 1990s, other countries are catching up. In the near future, the U.S. will be joined, first by Russia, and then by China. Of importance to Canadians, it is unlikely that any European producer will be able to maintain their current position in the emerging market. Like it or not, the era of the European fighter is coming to a close, and the industry could, in time, become a “U.S.-Asian duopoly.”38 And until (and unless) the Japanese or South Koreans make serious commitments to take their own next generation projects beyond the drawing board, the only realistic option for Canada’s fifth-generation purchase rests with the United States, Russia, or China.

Despite encountering recent technical problems, the U.S. F-22 Raptor is currently the only fully developed and operational fifth generation aircraft. As noted, however, its production has been halted.39 The U.S. is relying completely upon the JSF , which it will use to replace its existing fleet. Originally, the F-35 was to have been built in separate configurations for the U.S. Air Force, Navy, and Marine Corps respectively. However, due to technical problems, testing delays, and budgetary concerns, the development of the short take-off and vertical landing type was put on probation, and the plans for an alternative jet engine were discontinued.40 Today, the Pentagon plans to buy roughly 2400 units over the next three decades, with another 600 aircraft slotted for export. Following the 2008 global financial crisis, however, and with the resulting austerity measures being enacted by a number of governments, F-35 purchases might be scaled down.41

Nonetheless, the F-35 will be the first fifth-generation combat jet available for purchase, and it remains far ahead of its potential competitors in terms of testing. Despite minor setbacks, the F-35 flew over 750 times between the start of flight testing in 2006 and March 2011, and in October 2011, its short take-off and vertical landing capabilities were successfully demonstrated aboard the USS Wasp.42And while the program’s cost overruns and production delays have been worrying and troublesome, the development program is moving ahead. In July 2011, for instance, an F-35 was delivered to Eglin Air Force Base in Florida where it will be used to train new pilots. It is the third production model supporting testing missions.43 And according to the director of the JSF program, U.S. Vice Admiral David Venlet, the F-35s “… are ahead of their goals for the [2011] test program” and have “actually gone beyond what they were considered to be behind in 2010.”44 If so, the F-35 testing phase may be back on track.

Reuters RTR2Q11E by Sergi Karpukhin.

Russian Sukhoi T-50 in full display mode, 17 August 2011.

Other than the U.S., Russia has made the greatest progress in developing a next generation fighter. Even though the Russian aircraft industry is today a mere shadow of its former Soviet-era self, Moscow has made strides in recent years. It has undertaken enormous efforts to modernize its air force and is reorganizing the partially privatized aviation industry.45 Like the U.S., it began developing a fifth-generation aircraft in the 1990s. In early 2010, the prototype, designated the Sukhoi T-50 or PAK-FA, underwent test flights. At the August 2011 MAKS international air show in Zhukovsky, the jet made its first demonstration flight.46 Although it suffered engine problems at Zhukovsky, and has yet to undergo a number of important developmental hurdles before it can be properly compared to the F-35, the PAK-FA promises to be a highly competitive aircraft. Although its precise capabilities remain classified, it appears to have the attributes of a fifth-generation fighter.47 It has also gained international support; India has bought into the project, and is banking upon Russia to provide it with its next generation fighter.48

As for China, its aircraft industry has made an apparent quantum leap.49 Beijing has made huge investments in the state-controlled aviation industry in hopes of modernizing its air force. Until recently, China imported aircraft from Russia, or produced licensed or modified versions of Russian models. But in the meantime, China has also made its own indigenous advances. The Chengdu J-10 is Beijing’s first modern fighter jet. And in early 2011, China took the world by surprise by unveiling the prototype of its fifth-generation fighter, the J-20.50 While little is known about the aircraft, it appears to integrate Russian engines and technology. If so, it is possible that China’s recent advances were the result of purchasing, reverse-engineering, and then further developing Russian jet technology. However, since Russia already considers China to be a potential market competitor, export licenses for aviation technology are not always approved.51 The situation is different in the case of Western states. Despite the Chinese arms embargo, the U.S. and European countries continue to export dual-use technology to China. While on one hand it is profitable to do so, it is also possible that some of this equipment may have found its way into the J-20 program.52

What is probable, however, is that the Chinese will have their own operational fifth generation aircraft within a decade.53 Since the 1990s, China has reformed and strengthened its armaments industry with the goal of building strong, reliable, and self-sufficiently equipped armed forces. The aviation industry and the air force in particular, received preferential treatment in this process. Although the Chinese have yet to draw level with the U.S. and Russia, they will catch up. And although China has prioritized equipping its own air force, it is increasingly discovering export markets as a lucrative source of revenue. In the medium term, Chinese fighter jets will probably compete with 4+ generation types produced by Europe, Russia, and the U.S. for orders from developing countries. Most recently, in May 2011, it was reported that China had given – rather than sold – 50 upgraded JF-17 aircraft to Pakistan.54 As China’s military needs are met, it may well seek other trading partners. In the longer term, the Chinese might supersede the Europeans in the global market, and their fifth-generation aircraft – which will likely be affordable – will be a significant competitor for the respective U.S. and Russian models and 4++ generation types.

.jpg)

Reuters RTXWGD4 by Kyodo.

The Chinese J-20 stealth fighter on approach for landing at Chengdu, China, 13 January 2011.

That leaves Europe… In all likelihood, European producing states will continue to assert their market position for some time yet, bolstered by their 4+ generation aircraft. But that there is currently no European development program for a fifth-generation fighter suggests they may be facing eventual market extinction. It will be difficult for the Europeans to make up the development shortfall with regard to fifth-generation fighters, especially taking current fiscal concerns into consideration.55 Given the costs of leaping into the next generation of fighter technology, no individual European country – such as France or Sweden – is likely to remain in the game for very long. Averting a European decline will require the establishment of another multinational consortium – like the one behind the Eurofighter. But a consortium, which will ideally be joined by French and Swedish expertise, is unlikely to take root, given that several European states – including the UK, Italy, Denmark, the Netherlands, and Norway – have already partnered with the U.S. on the F-35 project.56 None are likely to eagerly pitch in for another expensive – and risky – program. Only slightly more promising is Anglo-French cooperation. Both nations have significant armament capabilities, and have declared their willingness to engage in defence and armament cooperation. Joint development of an unmanned aerial vehicle is one small but concrete step in this direction.57 But against this overall background, it is unlikely that a fifth-generation combat aircraft will be developed in Europe.

Eurofighter G. Lee.

A Eurofighter Typhoon.

The Politics of Procurement

Shifts in the global market for fighter jets will have political and policy ramifications. The purchase, sale, and trade of military equipment differ markedly from the trade of other goods. “Arms sales,” explains subject matter authority Andrew J. Pierre, “are foreign policy writ large.”58 According to Keith Krause, a Canadian political scientist and currently the Director of the Centre on Conflict, Development and Peacebuilding at Geneva’s Graduate Institute of International Studies, with respect to the supply side, states participate in the production and transfer of arms for three principle reasons: for wealth, military victory, and power. In terms of wealth, the arms trade generates foreign exchange, reduces the costs of research, development, and procumbent through economies of scale and export sales, creates domestic employment opportunities, and can help sustain economic growth through military production. As for victory, weapons are produced to safeguard a domestic arms supply and are exported in exchange for rights over foreign military bases, to assist and defend friendly states, to substitute for “direct military involvement”, and/or to provide grounds for testing newly developed technology. In terms of power, states trade arms in order to have access to and influence over foreign leaders, to signify and solidify a commitment to defend another state, to influence regional balances of power, to establish a regional presence, and to gain access over scarce or strategic resources.59

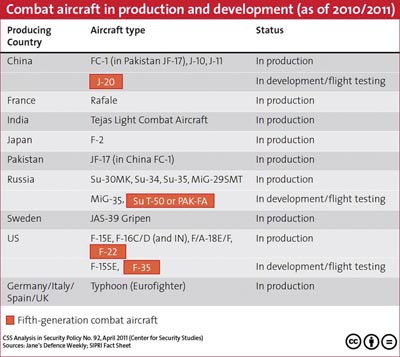

Chart – Combat aircraft production

On the demand side, states are motivated to purchase and acquire foreign armaments for internal, regional, and systemic rationales. In the first instance, foreign weapons can help a regime defend itself against internal threats or help it drive domestic modernization programs. In terms of regional dynamics, weapon transfers can guarantee a state’s security, help it fight and win a war, and let it gain influence over neighbours. Systemically, acquiring weapons can allow a state to pursue “status, power, and prestige”.60 This schema is echoed by Barry Buzan, a Professor of International Relations at the London School of Economics, and Dr. Eric Herring of the University of Bristol, who suggest that states effectively follow a combination of an “action-reaction model” – states strengthen their armaments because of the threats they perceive from other states – and a “domestic structure model” – states are motivated to arm themselves because of internal forces.61

In either case, politics often informs both a producer’s motivation to transfer arms to another state and a recipient’s motivation to acquire arms from another state. This was particularly evident during the Cold War, when opposing Western and Eastern blocs duelled over global political support by using the arms trade as an instrument of foreign policy. The acquisition of arms from one of the two superpowers was widely acknowledged as evidence of a state’s allegiance. Clients became allies. But the politicking behind the Cold War’s arms trade was nothing new. “Arms transfers have been used at least since the Peloponnesian Wars,” writes Krause, “to achieve the political, military and economic goals of states and rulers.”62 The same principle exists today. What distinguishes the arms market from, say, the automobile market, is the pervasive influence of political considerations in driving policy, shaping decisions, and influencing state behaviour.63 This is especially evident when it comes to fighter jets. When one government decides to purchase sophisticated military hardware – like combat jets – produced by another state, it is not only thinking about improving the quality of its armed forces, but also about the political and strategic signals it is sending to other countries (and its own citizens) with its purchase.

The transformation of the market for combat aircraft will change the political and military balance of power. Future competition for orders between Beijing, Washington, and Moscow will be motivated by both economic and political considerations. Rather like the Cold War, ‘the name of the game’ will be to create mutual dependency between the leading players with those on the ‘buy’ side. By choosing their source of imports, buyer countries will reveal their geostrategic alignment. And given that there will be fewer suppliers in the market; these political and military dependencies will inevitably increase.

Conclusions

Where does that leave Canada? Ideally, it will buy its next fighter from an ally. This goes beyond ensuring continued military interoperability. At issue is that Ottawa must avoid sending an unintended political message with its purchase. Likewise, buying from a friendly state will pre-emptively ‘grease the wheels’ in the event spare parts are needed during a crisis or conflict. Getting caught in an international dispute in which Canada’s interests rest on one side of a political divide, while the pieces it needs for its aircraft are stranded on another, would be foolish. And it is also important that Canada signs off with a producer that will survive over the long haul, which will ease with maintenance and future developments.

Lockheed Martin photo.

F-35 Lightning II

Given that upgraded fourth-generation jets will eventually go obsolete, and that the emerging fifth-generation market will be dominated by the U.S., Russia, and China, Canada has but one choice: the F-35. Given its political and social history, its normative and ideological preferences, and its alliance partnerships, Canada is in no position to buy Russian or Chinese military hardware. The political and strategic ramifications of replacing an American-led initiative like the F-35 with a Russian or Chinese program would be monumental, if not catastrophic.

The JSF program has proven to be an exorbitantly expensive, imperfect, and risky endeavour. Canadians are right to debate the merit and cost of their participation. And yet, Canada has few viable alternatives. Arguments suggesting Canada can replace its ageing CF-18s with ‘souped-up,’ fourth-generation versions, ignore the bigger picture: these aircraft, no matter the upgrades, will eventually go the way of third- and second-generation aircraft – that is, to the dump. Flying a modern air force will require investing in fifth-generation technology, and unless Canadians are prepared to sacrifice American, European, and Western political relations as well as general goodwill in order to fly Russian or Chinese jets into combat, the F-35 is the only remaining option. And, of course, Ottawa should not presuppose that Moscow and Beijing would be willing to sell Canadians their most sophisticated hardware.

NOTES

-

Matthew Bell, Mark Bobbi and Keri Wagstaff-Smith, “JSF : Weighing up the partner nation benefits,” in Jane’s Defence Weekly, 3 February 2010, p. 23.

-

John Reed and John Bennett, “Canada’s Sole-Source Buy Boosts the F-35,” in Defense News, 16 July 2010.

-

Lieutenant-General (ret’d) Lloyd Campbell, “Replacing the Canadian Manned Fighter Capability,” in Canadian Military Journal, Vol.11, No.3, (2011), p. 59.

-

Martin van Creveld, “The Rise and Fall of Air Power,” in The RUSI Journal, Vol. 156, No. 3, (2011).

-

David McDonough, “Canada and the F-35 Procurement: An Assessment,” in Canadian International Council Commentary (29 October 2010); Philippe Lagasse and Justin Massie, “Tories and Grits are as one on Defence Policy,” in The Globe and Mail, 4 August 2010.

-

“U.S. Fuel Stops Gripen Libya Mission,” in The Local, 7 April 2011.

-

John Tirpak, “The Sixth Generation Fighter,” in Air Force Magazine (October 2009), p. 40.

-

“FAQs,” The F-35 Lightning II Program, at http://www.jsf.mil/contact/con_faqs.htm, accessed 21 November 2011.

-

Lieutenant-General André Deschamps, “Meet the F-35 Lightning II – Canada’s Next Fighter,” in Canadian Military Journal, Vol. 11, No.1 (2010), p. 50.

-

John Tirpak, “Fighter of the Future,” in Air Force Magazine (July 2009), pp. 22-27.

-

John Tirpak, “New Life for Old Fighters,” in Air Force Magazine (February 2011), pp. 28-34; John Tirpak, “Flatline Danger,” in Air Force Magazine (April 2011), pp. 30-35; Bill Sweetman, “Hornet Buffs Up,” in Aviation Week, 13 July 2011.

-

Rahul Bedi, “High and Mighty: Indian Air Force Capabilities,” in Jane’s Defence Weekly, 2 February 2011; Ron Matthews, Alma Lozano, and Pathikrit Payne, “India’s Medium Fighter Purchase: Strategic Considerations,” in RSIS Commentaries, No. 92 (2011); Julian Kerr, “RAAF receives first batch of Super Hornets,” in Jane’s Defence Weekly, 7 April 2010, p. 32.

-

Winslow Wheeler, “Should Canada Reconsider its F-35 Purchase?” in Embassy, 4 April 2011; Winslow Wheeler, “Canada’s Next Generation Fighter Aircraft,” Testimony to Parliament of Canada, Standing Committee on National Defence, December 2010.

-

Ron Ennis, “New Stealth Fighters Lack Ability to Communicate from Canada’s North,” in The Globe and Mail, 23 October 2011.

-

Reuben Johnson, “The Air Force We Won’t Have … Alas: Is the Era of Power Projection Over?” in The Weekly Standard Vol. 16, No. 5 (2010).

-

Dave Majumdar, “F-35 Tests Proceed, Revealing F/A-18-Like Performance,” in Defense News, 16 May 2011.

-

David Perry, “Canada’s Joint Strike Fighter Purchase: Parsing the Numbers,” in On Track, Vol. 16, No. 2 (2011), pp. 19-23; Office of the Parliamentary Budget Officer, “An Estimate of the Fiscal Impact of Canada’s Proposed Acquisition of the F-35 Lightning II Joint Strike Fighter,” 10 March 2011; Wheeler, Should Canada Reconsider….

-

Kate Brannen, “Senators Question Move to Shift Funds to JSF ,” in Defense News, 14 July 2011; Gopal Ratnam and Tony Capaccio, “Panetta says Budget Cuts may Kill Lockheed’s F-35 Jet,” in Bloomberg, 15 November 2011.

-

We would like to thank Mark Murray for his insightful comments on this article.

-

Jim Garamone, “DOD Certifies 6 Programs under Nunn-McCurdy Law Breaches,” in U.S. Air Force, 2 June 2010; Ashton Carter, David van Buren, and David Venlet, “Joint Strike Fighter,” Testimony before the Senate Armed Services Committee, 19 May 2011; The Economist, “The Last Manned Fighter,” 14 July 2011.

-

John Bennett, “DoD to Brief F-35 Partners on Program Changes,” in Military Times, 2 March 2010; John Reed, “Israel Commits to F-35 Purchase,” in Defense News, 7 October 2010; Dave Majumdar, “Fighter Jet Producers Circle Pivotal Mideast,” in Defense News, 14 November 2011; “U.S. Ready to Offer F-35 JSF Stealth Jet to India,” in Ria Novosti, 2 November 2011; Tim Kelly, “Lockheed to Offer F-35 Work to Japan Firms,” in Aviation Week (6 October 2011).

-

These arguments were first expressed by Marco Wyss, “Clashing over Fighters: Winners and Losers,” in CSS Analysis in Security Policy, No. 92 (April 2011), and in Alex Wilner and Marco Wyss, “The Case for the F-35,” in National Post, 16 May 2011.

-

Reuben Johnson, “Pakistan Increases Autonomy in JF-17 Thunder Production,” in Jane’s Defence Weekly, 28 July 2010, p. 5.

-

For an overview of all fighter jets currently in production, see Robert Hewson, “Fighter Club,” in Jane’s Defence Weekly, 14 July 2010, pp. 61-76.

-

Information Office of the State Council of the People’s Republic of China, “China’s National Defense in 2008,” at Chinese Government’s Official Web Portal, accessed 22 July 2011; Michael Flaherty, “Red Wings Ascendant: The Chinese Air Force Contribution to Anti-access,” in Joint Forces Quarterly, Vol. 60 (2011), pp. 95-101.

-

All figures from Siemon Wezeman, “International Transfers of Combat Aircraft, 2005-2009,” in SIPRI Fact Sheet (November 2010), p. 3.

-

Pierre Tran, “Mideast Setback for Rafale, Dassault,” in Defense News, 20 November 2011.

-

See the SIPRI Arms Transfers Database, at http://www.sipri.org/databases/armstransfers.

-

Gregor Ferguson, “Australia Unruffled by F-35 Delays,” in Defense News, 19 March 2010.

-

Hanspeter Mettler, “Die Kompensationsgeschäfte rücken ins Zentrum,” in Neue Zürcher Zeitung, 12 March 2010, p. 13.

-

Vikas Bajaj, “U.S. Loses Bids to Supply Jets to India,” in the New York Times, 28 April 2011; Rahul Bedi, “India shortlists Typhoon, Rafale for MMRCA race,” in Jane’s Defence Weekly, 4 May 2011, p. 5.

-

Robert Hewson, “After the Right F-X,” in Jane’s Defence Weekly, 18 May 2011, pp. 28-31.

-

Wendell Minnick, “Western Jetmakers Vie for Asian Contracts,” in Defense News, 20 June 2011.

-

These figures are for 2008, and do not include Chinese companies. See Wezeman, “International Transfers,” p. 1; Susan Jacks and SIPRI Arms Industry Network, “The SIPRI Top 100 Arms-producing Companies, 2008,” in SIPRI Fact Sheet (2010), pp. 1-7.

-

Martin van Creveld, Technology and War, (New York: Free Press, 1989), p. 1.

-

Richard Bitzinger, “Global Fighter Jets: Asia, the New Centre of Gravity?” in RSIS Commentaries, No. 59 (2011).

-

Bruce Rolfsen, “F-22 Stealth Maintenance Issues Hit Mission Rates,” in Jane’s Defence Weekly, 23 February 2011, p. 6; Scott Fontaine and Dave Majumdar, “USAF Indefinitely Grounds F-22 Raptors,” in Defense News, 5 May 2011.

-

Jeremiah Gertler, “F-35 Joint Strike Fighter Program: Background and Issues for Congress,” in CRS Report for Congress, 22 December 2009, p. 7; Christopher Drew, “House Votes to End Alternate Jet Engine Program,” in New York Times, 16 February 2011.

-

The Economist; “UK air force may have its wings clipped,” in IISS Strategic Comments, Vol. 16, No. 6, September 2010; Menno Stekettee, “Netherlands commits to Second Pre-production F-35,” in Jane’s Defence Weekly, 13 October 2010, p. 13.

-

Caitlin Harrington Lee, “F-35 Flight-testing ‘Ahead of Schedule,’”, in Jane’s Defence Weekly, 13 April 2011; Dave Majumdar, “Marine Corps Demonstrates F-35B at Sea,” in Military Times, 18 October 2011.

-

Dave Majumdar, “Eglin Air Force Base Gets 1st Production F-35,” in Defense News, 14 July 2011.

-

Dave Majumdar, “Interview with U.S. Vice Adm. David Venlet, F-35 Program Chief,” in Defense News, 20 June 2011.

-

See Isabelle Facon and Michel Asencio, Le renouveau de la puissance aérienne russe, Rapport No. 445, Paris: Fondation pour la Recherche Stratégique, 2010, pp. 58-113.

-

“Russia’s 5G Fighter Makes First Demonstration Flight,” in Ria Novosti, 17 August 2011; “Engine Woes force Russian T-50 to Abort Takeoff,” in AFP, 21 August 2011.

-

Gareth Jennings, “Russian PAK-FA Fifth-generation Fighter makes Maiden Flight” in Jane’s Defence Weekly, 3 February 2010; Reuben Johnson, “PAK-FA Flight Trials Continue on Track,” in Jane’s Defence Weekly, 24 February 2010, p. 5; “Russia tests 2nd Prototype of Fifth-generation Fighter,” in RIA Novosti, 3 March 2011, p. 16 ; “Experte: Russischer Kampfjet der Zukunft ist F-35 überlegen,”in RIA Novosti, 10 October 2010.

-

Ilya Kramnik, “India Chooses Russian Prototype for Its Fifth generation Aircraft,” in RIA Novosti, 11 October 2010.

-

See Tai Ming Cheung (ed.), Journal of Strategic Studies Special Issue: China’s Emergence as a Defense Technological Power, Vol. 34, No. 3 (2011).

-

Craig Caffrey, “Up and coming: Chinese Military Aircraft,” in Jane’s Defence Weekly, 7 July 2010, pp. 24-25; Jon Grevatt and Julian Kerr, “China sets the tone,” in Jane’s Defence Weekly, 16 February 2011, pp. 23-27.

-

Keri Wagstaff-Smith, “Russia Stalls on Deal to Supply Engines to China,” in Jane’s Defence Weekly, 14 July 2010, p. 12.

-

Marco Wyss, “Revisiting the ‘Nene Blunder’: Western Aviation Technology Transfers to China,” in LSE IDEAS Today, Issue 8, 2011, pp. 16-18.

-

Reuben Johnson, “Eastern Approaches: Asia’s Next-generation Fighter Programmes,” in Jane’s International Defence Review, May 2011.

-

Jane Perlez, “China Gives Pakistan 50 Fighter Jets,” in New York Times, 19 May 2011.

-

“Unmanned Future: The Next era of European Aerospace?” in IISS Strategic Comments, Vol. 17, No. 24, June 2011.

-

Michele Nones, Giovanni Gasparini, and Alessandro Marone, Europe and the F-35 Joint Strike Fighter Program, Quaderni IAI, Rome: Istituto Affari Internazionali, 2009.

-

Pierre Tran, “Britain, France Treaty Has Borne ‘First Fruits,’”in Defense News, 16 March 2011.

-

Andrew Pierre, The Global Politics of Arms Sales, (Princeton, NJ: Princeton University Press, 1982), p. 3.

-

Keith Krause, Arms and the State, (Cambridge, MA: Cambridge University Press, 1995), pp. 97-98.

-

Barry Buzan and Eric Herring, The Arms Dynamic in World Politics, (Boulder, CO: Rienner, 1998) pp. 81-119.

-

Robert Harkavy, “The Changing International System and the Arms Trade,” in The ANNALS 535, 1994, p. 14.